Get Business Finance Services for Custom Funding Needs

Comprehensive financial assistance to help businesses grow and achieve excellence in their operations.

Best Business Finance Solutions Under One Roof

Aspire Capital Group aims to provide diverse funding services. We have experts who recommend tailored solutions for clients to help them meet their firm’s monetary needs.

Our multifold finance options allow our clients to grow their businesses seamlessly. Our firm ensures easy equipment financing to facilitate borrower firms to expand their business operations and target immense growth.

+

+

+

+

Funding Services We Offer

Equipmеnt Loan

Small Businеss Loans

Property Mortgage Services

Complete Funding Process

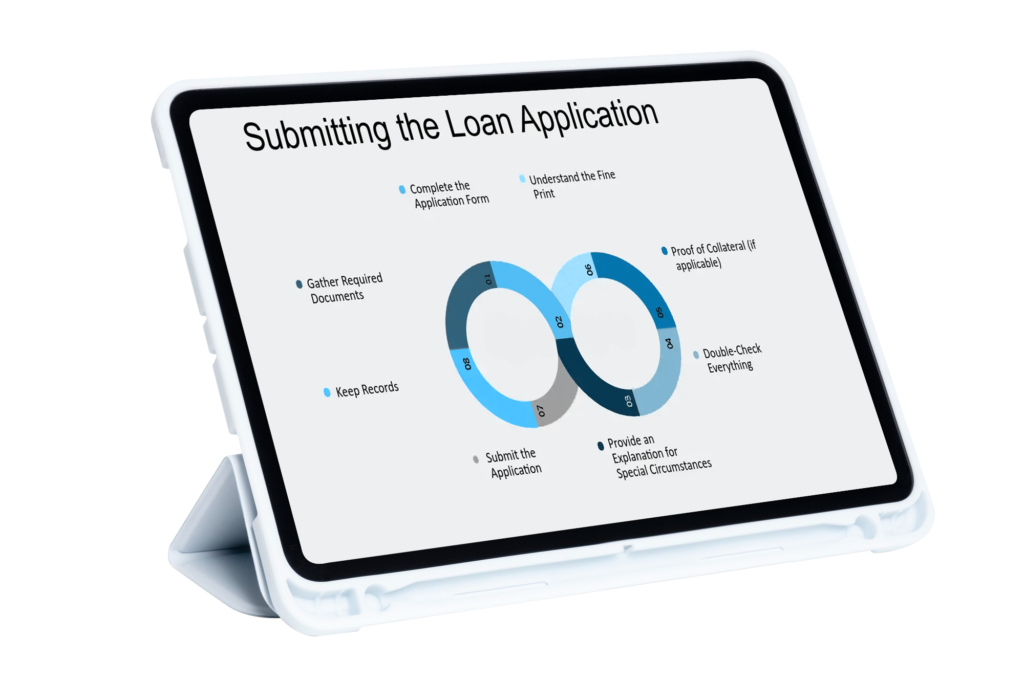

Loan Application and Documentation

Finding Suitable Lenders

Finding Suitable Lenders

Final Agreement and Fund Disbursal

Expert Financial Services for Full Client Satisfaction

Our team of professionals ensures customer-centric solutions to help our clients meet their financial goals offering them satisfaction.

-

“I would like to express my gratitude to Aspire Capital for assisting me with my home loan. Kriti guided me through the entire process, and I highly recommend their business finance services. The staff is incredibly helpful, ensuring smooth and efficient processing. I truly recommend them.’’

Roma Ahuja

4.8 -

“I had been searching for a suitable loan plan for a while when I discovered Aspire Capital Group. Four months ago, I contacted them for a truck loan, and Ms. Riya, their executive, was incredibly helpful and cooperative. She facilitated the process, securing a commercial loan with low interest and a minimal down payment in just three days. I highly recommend Aspire Capital Group to anyone seeking a truck loan!’’

Jatinder Dhillon

4.8 -

“It took only 2 days, and our business was funded. Riya, our lending advisor, maintained constant communication and explained the entire process in great detail. Aspire Capital will undoubtedly be at the top of our list if we need funding in the future. 7 stars.’’

Asim

5.0 -

“Best service and the finest assistance provided. The staff is friendly and cooperative, making it the best place to secure your future.’’

Parvinder Singh

4.8

Are you Searching for Funding to Grow Your Business?

Our financial advisory services cater to custom business capital needs across the US.

Let’s Get Started !

Transforming Financial Visions into Reality: Get Expert

Consultation.

Phone Number:

(516)-859-6300

Mail Address:

sales@aspirecapitals.com

Office Address:

94-23 Lefferts Boulevard, South Richmond Hill, NY 11419Get A Quote

Frequently Asked Questions

Get insights about our financial services by going through the FAQs asked by our visitors!

The completion of the application process takes from 24 to 48 hours. After that, the time taken for the disbursement of funding will depend on multiple factors and vary for different applicants.

Quick Links

Contact Details

- 94-23 Lefferts Boulevard, South Richmond Hill, NY 11419

- sales@aspirecapitals.com

- (516)-859-6300